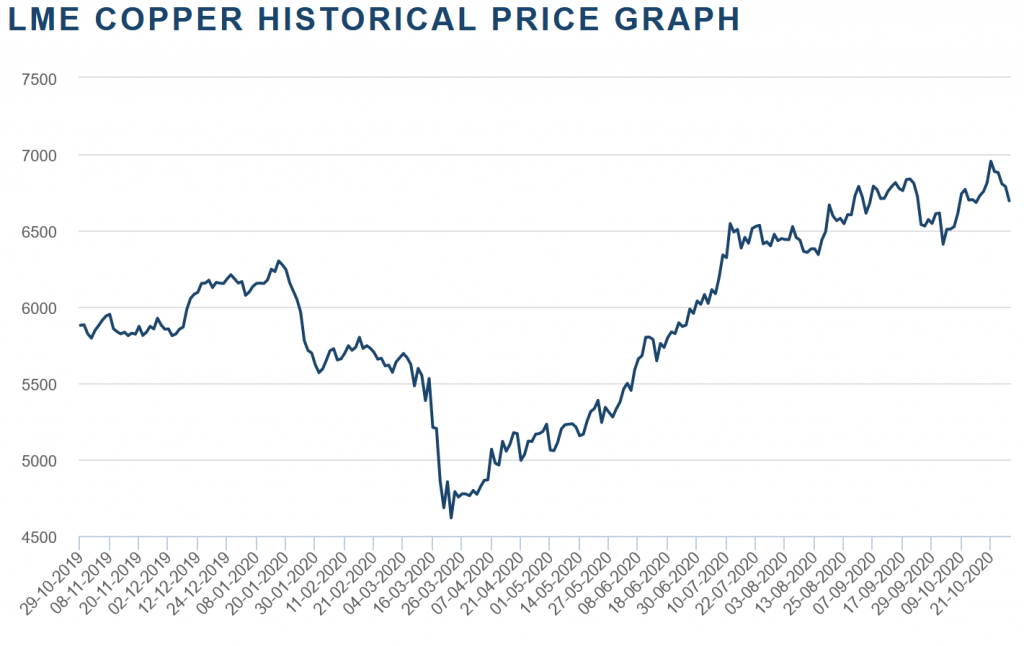

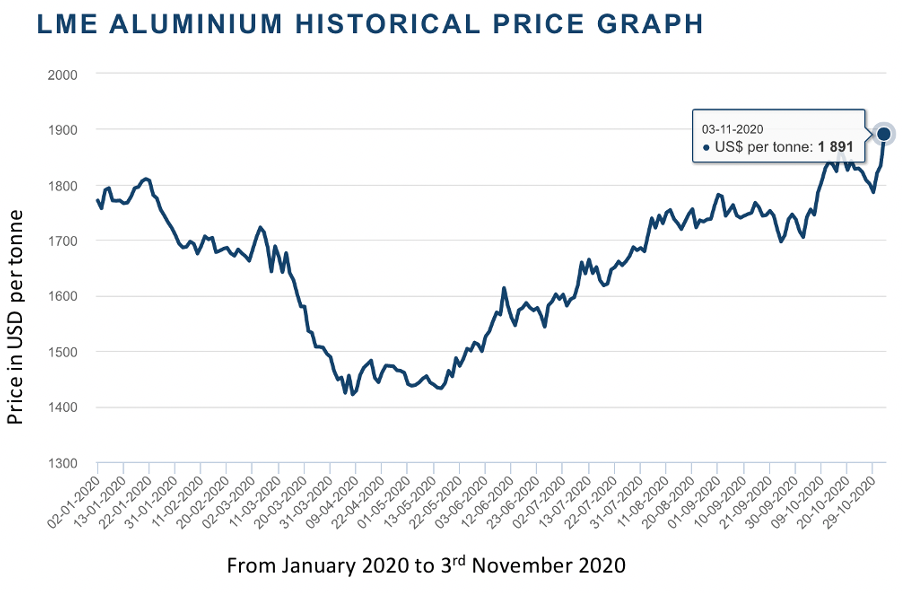

Price movement recap

Chinese, transportation and construction industry demand are factors influencing the price. Worldwide lockdowns in March led to the closure of plants and construction sites. Transportation and automotive industries demand decreased as well, due to the decrease in travelling, an increase of telecommuting, the interruption of Chinese parts exports and manufacturing and assembly plants. This explains the price fall at the beginning of the year, which has slowly increased since mid-May.

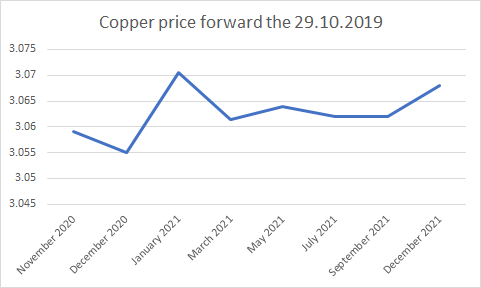

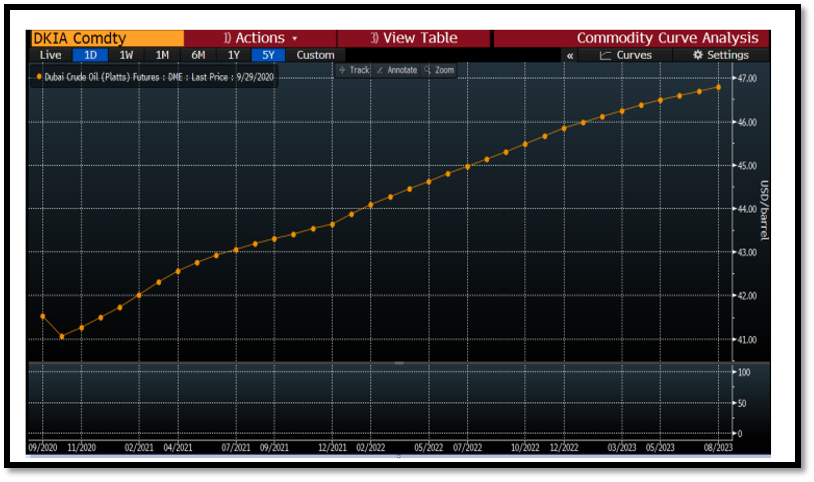

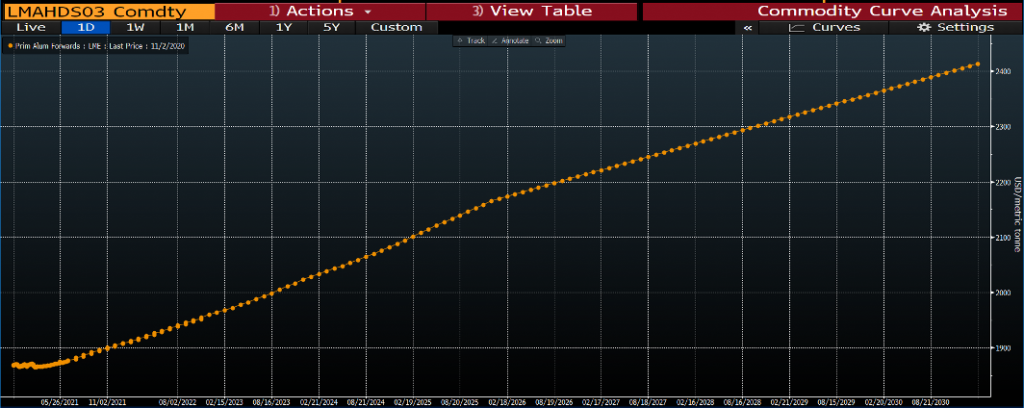

Forward curve

As it can be observed, the market is in contango. It makes sense as demand is expected to grow in the few months and the market is oversupplied. Companies can therefore easily stock.

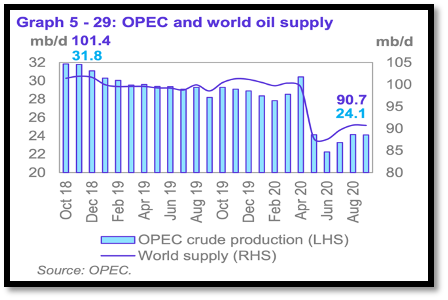

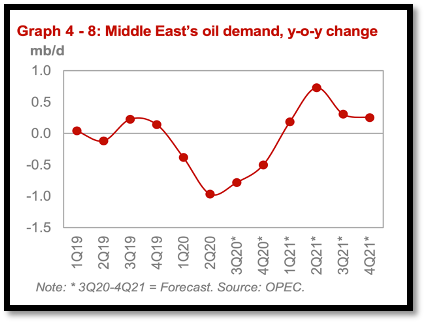

Supply and demand dynamic

As said above, China has a huge impact on supply and demand. Its monthly output is expected to rise for the end of the year as smelters are reopening and increasing their capacities. The global demand is expected to grow again as Asian countries and are recovering from the first wave of Covid-19 and are less impacted by the second wave. The fact that Asian countries are not facing right now such a high contamination rate as in Europe has given a new wind of optimism and exports have surged in the region. China has become even more than before the driving force of production and demand in the aluminium market.

In addition, a switch to can consumptions has been fastened by the COVID-19. While cans were already starting to be preferred thanks to their ease of recycling, the shutdown of restaurants has shifted the consumption from glass bottles to cans. Consequently, there is not enough capacity to meet demand. Ball corp., the largest producer of cans, is unable to make up to 8 billion cans for the year. It is important to note that this shift is unlikely to go away with the pandemic.

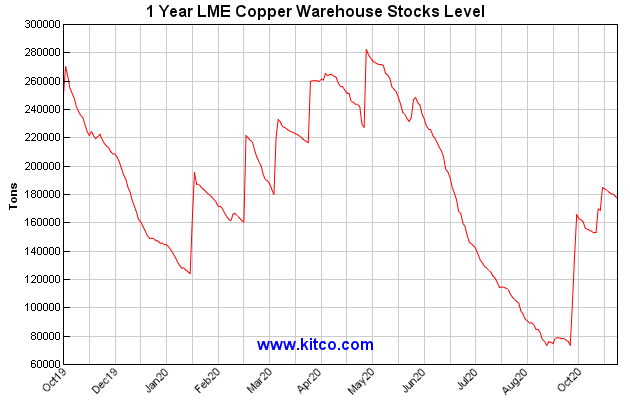

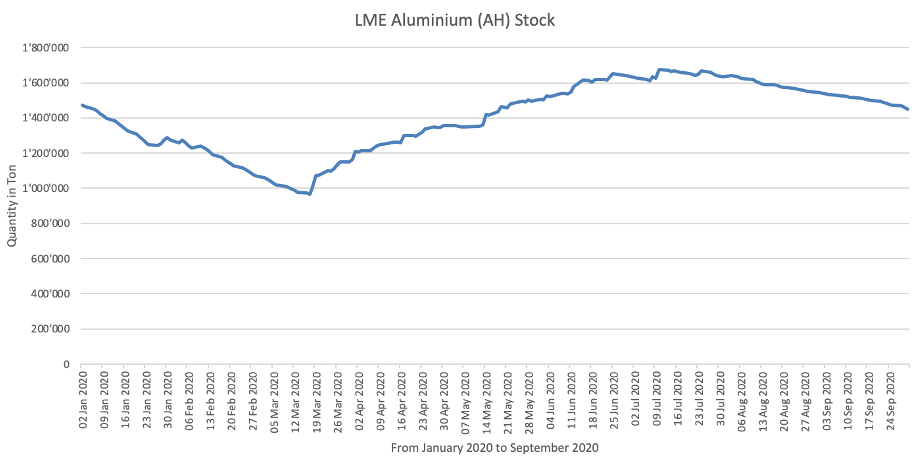

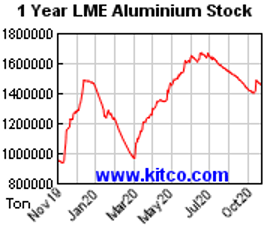

Inventory levels

As an effect of the COVID-19, the largest producer, China, has put in place a lockdown, which stops the production from at the beginning of the year. The lowest level was reached in March with the lockdown of the other countries. Then China recovered first from the epidemic, though recovery of production starting at the end of March increasing stocks. Stocks are now reaching the same level as before lockdown.

Recommendations

Due to the actual oversupplied and the growing demand, prices are expected to rise. However, in the long-run, when supply will be more balanced with demand, the surplus will be none, and prices will probably rise even more.

Beatriz Ferreira Caetano, Virginie Gruaz and Mingxin Ma

References

Aluminum Can Market Fizzes Amid Struggle To Meet Surging Demand | Seeking Alpha, [no date]. [online]. [Viewed 5 November 2020]. Available from: https://seekingalpha.com/article/4383019-aluminum-can-market-fizzes-amid-struggle-to-meet-surging-demand?utm_source=bloomberg&utm_medium=referral

Aluminum Futures Quotes – CME Group, [no date]. [online]. [Viewed 5 November 2020]. Available from: https://www.cmegroup.com/trading/metals/base/aluminum.html

ARNOLDI, Marleny, [no date]. Aluminium demand growth will soon outpace production growth. Mining Weekly [online]. [Viewed 5 November 2020]. Available from: https://www.miningweekly.com/article/aluminium-demand-growth-will-soon-outpace-production-growth-2020-10-30/rep_id:3650

Can Shortage Lets Up But Some Molson Products Will Go – Bloomberg, [no date]. [online]. [Viewed 5 November 2020]. Available from: https://www.bloomberg.com/news/articles/2020-10-29/beer-can-shortage-lets-up-but-that-won-t-save-some-molson-brands

Kitco – Spot Aluminum Historical Charts and Graphs – Aluminum charts – Industrial metals, [no date]. [online]. [Viewed 5 November 2020]. Available from: http://www.kitcometals.com/charts/aluminum_historical.html

London Metal Exchange: LME Aluminium, [no date]. [online]. [Viewed 5 November 2020]. Available from: https://www.lme.com/en-GB/Metals/Non-ferrous/Aluminium#tabIndex=2

London Metal Exchange: Warehouse and queue data, [no date]. [online]. [Viewed 5 November 2020]. Available from: https://www.lme.com/Market-Data/Reports-and-data/Warehouse-and-stocks-reports/Warehouse-and-queue-data

Matières premières: l’aluminium marque une pause, l’or et le sucre dérapent, 2020. Allnews [online]. [Viewed 5 November 2020]. Available from: https://www.allnews.ch/content/news/mati%C3%A8res-premi%C3%A8res-l%E2%80%99aluminium-marque-une-pause-l%E2%80%99or-et-le-sucre-d%C3%A9rapent