By Lyticia Wouguia, Christopher Delfin, Piratharsan Poologanathan

Russia imposes export tax and quota

Russia, one of the world’s largest wheat exporters, recently issued a list of orders aimed at stabilising domestic food prices, including a grain export quota and wheat export tax. These new measures will start from 15th February 2021 until 30th June 2021. The government introduced a quota for overseas shipments of wheat, rye, barley and corn limiting exports to 17.5 million tonnes. In addition, along with that quota, they also implemented a wheat export tax of 25 euros or 30.40 US dollars per tonne. Furthermore, if export volumes are higher than the quota, the tax for wheat would rise to 50% of the customs price or 100 euros per tonne, whichever is higher.

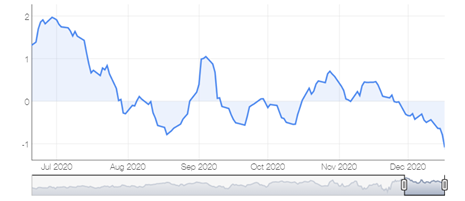

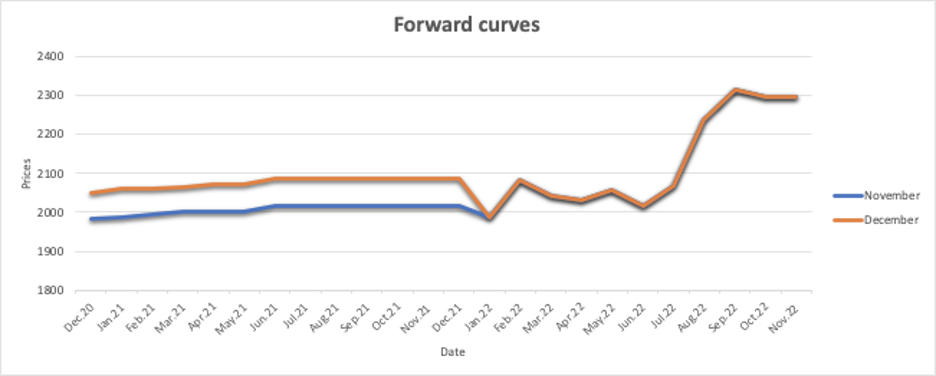

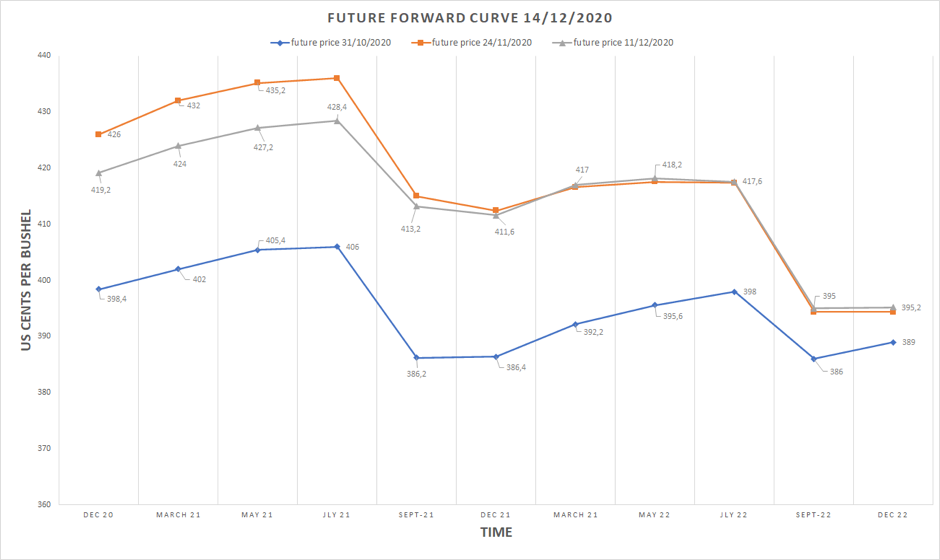

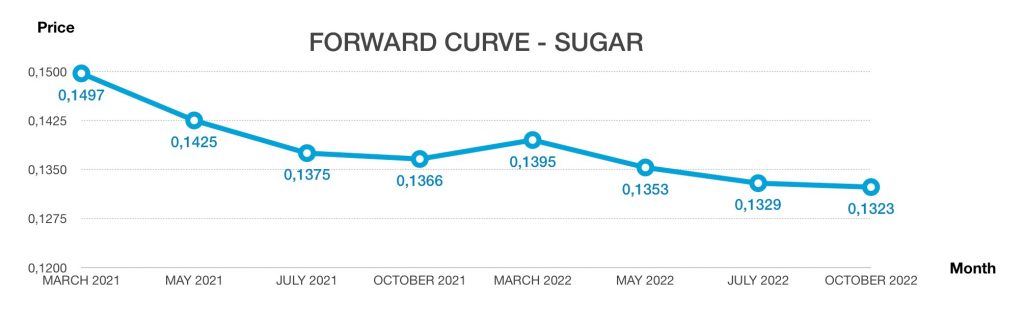

The figure below are the futures prices in the black sea wheat market. There is a steady increase in the beginning of the year until May, which makes the market in a normal curve. The reason behind the increase is partially due to the new measures which were mentioned in the previous paragraph. As the regulation is from Feb-June, the tax could reduce Russia’s wheat export which makes the futures prices higher in those months. Another reason for high prices is due to low wheat production caused by prolonged dry weather and a strong demand from global buyers. The bad weather condition has disrupted and delayed planting of the major wheat producing and exporting countries.

Black sea wheat futures

Turkey grains import tax cut likely to be extended

The Turkish government decided to suspend tariffs on wheat, maize and barley at the end of October in order to support its domestic milling market against a backdrop of rising international prices and concerns about local food security. The suspension is expected to end in early calendar year 2021. But as the Covid-19 pandemic continues to threaten domestic supplies, it seems likely that import tariffs will remain lifted at least until the end of the current crop year, on 30 June 2021.

The extension of the tax reduction until next year would allow importers more time to reap the benefits of this measure, as the Turkish lira depreciates in value – caused by inflation and concerns about the Covid-19 recession. Indeed, Covid-19 has increased the costs of international wheat supply for Turkish buyers in recent weeks.

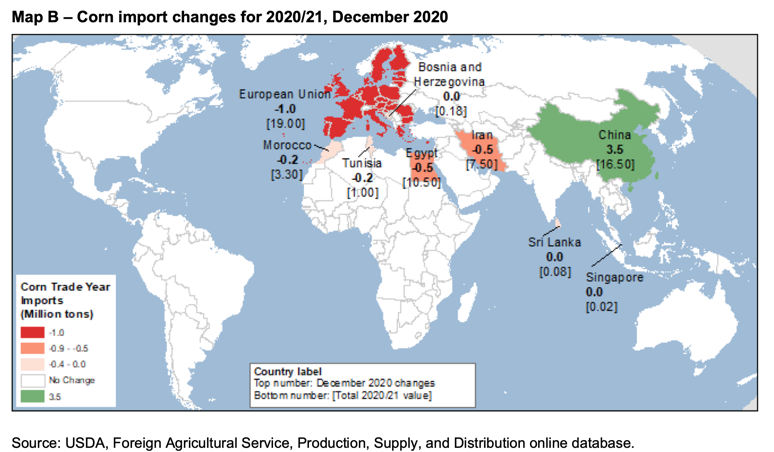

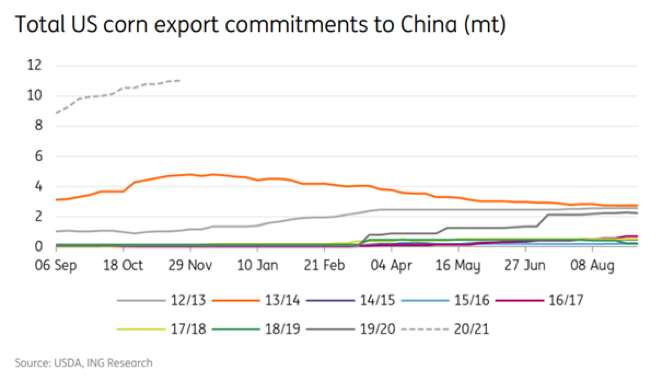

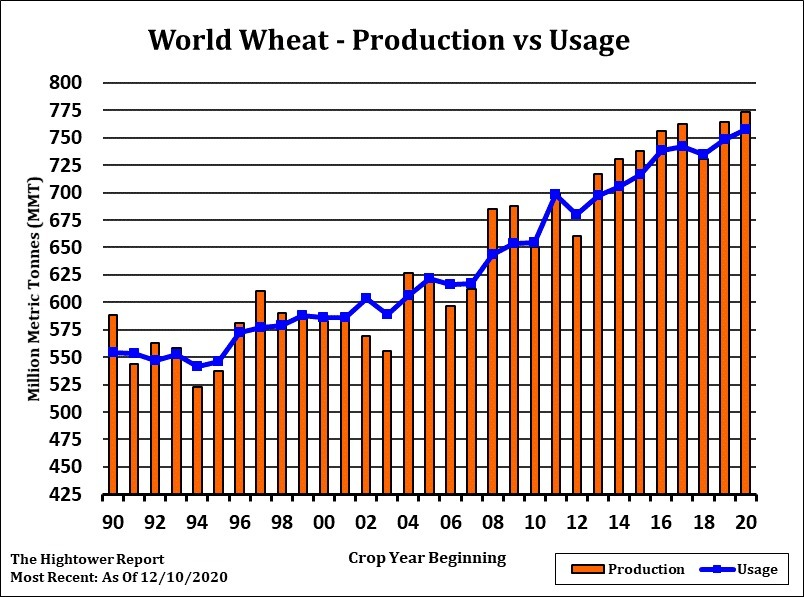

Demand

The global demand is increasing due to several reasons. The main importer’s countries are increasing the amount of wheat entering their land. The global consumption has reached 757.8 million for 2020 and 2021. Even though the production has increased by 1.2 million to reach the record global production at 773.7 million. It is not enough to reach the demand of certain countries. Indeed, China, for example, has increased their demand. It is mainly explained by the need to feed livestock. China is not the only one to increase, Pakistan as well has raised the import. Furthermore, the world ending stock is expected to lower for 2020/21.

Supply

Due to the increasing demand, the supply is looking for larger producers. As explained in the previous bulletin, the australian production is expected to increase. Russia’a production has also increased. Nevertheless, in order to protect the local farmer from raising prices, they will impose a tax on export in the near future. Canada’s wheat production has a slight increase in their production.

Recommendation

Due to the new measures, this has triggered volatility in global wheat prices. A trader should look for different markets in order to make profit and avoid the uncertainties. It is also important to check for trends in the industry and futures markets as demand keeps on increasing. In our opinion, it is better to lock in prices today before the regulations come into effect in mid-February.

Sources:

https://www.barchart.com/futures/quotes/KF*0

https://www.argusmedia.com/en/news/2157551-turkey-grains-import-tax-cut-likely-to-be-extended

http://dtn.agfax.com/index.cfm?show=62&subtype=5

https://www.usda.gov/oce/commodity/wasde/wasde1220.pdf

https://www.cmegroup.com/trading/agricultural/wheat-reports.html