Price movement recap

During the last 3 weeks, the oil price had first declined due to the lockdown announcements and political election uncertainties. Afterwards the oil price rebounded thanks to the Biden’s election (production in the US is expected to decrease + no more uncertainties on this election). Biden’s diplomacy is also a positive factor compared to Trump’s unpredictability. The optimistic outlook of 90% effective vaccines from Pfizer and 94.5% effective vaccines from Moderna allowe the market to rise, especially in the transport and energy (oil) sectors.

Futures prices / Cost Curves:

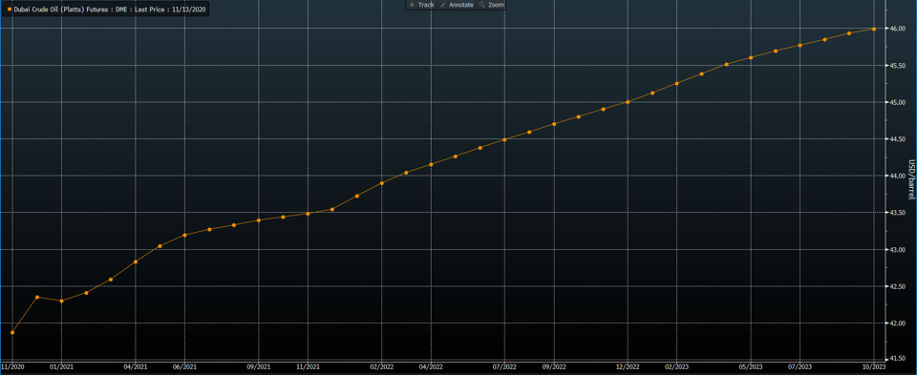

The Gulf Oil market is still in contango. Indeed, because of the Covid-19, supply remains higher than demand. However, if the vaccine developed by Pfizer and Biontech proves to be effective, we expect the price curve to flatten slightly in the coming months but still in contango. According to IEA (International Energy Agency), the Covid-19 vaccine is unlikely to raise oil prices until the end of 2021. A weaker demand outlook combined with rising supply is putting pressure on global producers to hold back output in order to support prices.

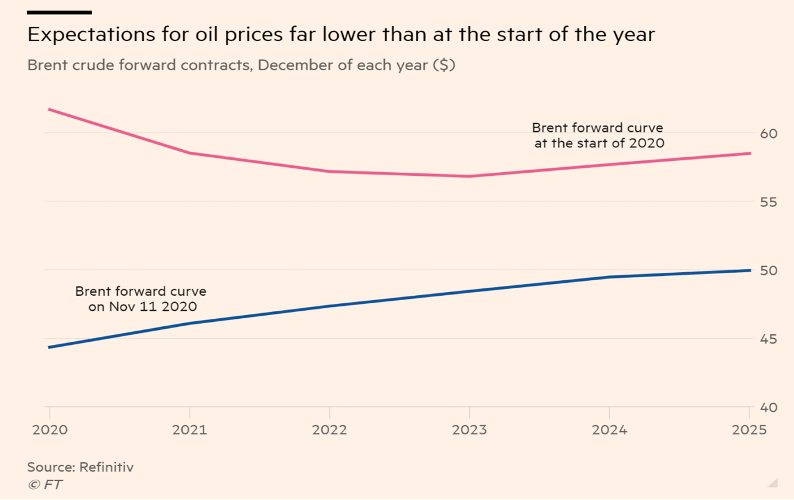

As explained above, the forecast for demand in the coming years is lower than it was at the beginning of the year. As shown in the chart below, this will necessarily impact the level of prices downward (supply > demand). We have used the Brent forward curve as there is not enough data on Dubai Crude. However, as the correlation between the different types of oil is very high, the scenario will be very similar for Gulf Oil.

Supply and demand dynamic

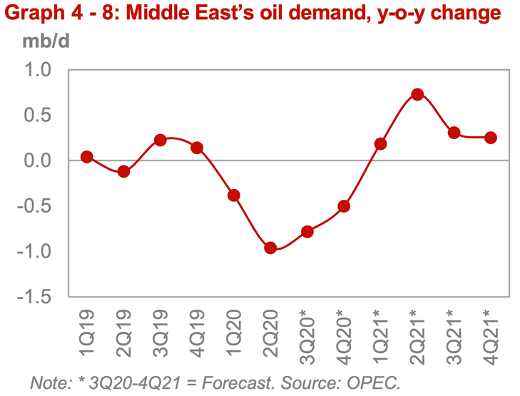

As we can see on graph 4, oil demand in the Middle East has not changed in the last 3 weeks. However, OPEC expects a decrease in demand for the end of 2020 and in 2021. Therefore, they will change their production plan as of January 2021. These changes are still due to Covid-19 and will last until mid-2021. Finally, we expect an upturn in demand thanks to optimistic forecasts of the Indian and Chinese economies.

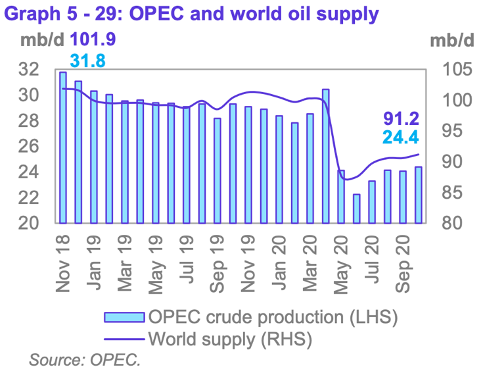

Regarding the production, as shown in graph 5, it has slightly increased in September but is still very low compared to the same period in 2019. Finally, between the 30th November and 1st December OPEC members will meet the non-OPEC allies to discuss the production policy. The results of this meeting will also have an impact on price levels.

Recommendations

The market is still in contango and, from our point of view, will remain so for a long time. From an investment perspective, we still recommend to be long for the next 3 to 6 months. If the Covid-19 vaccine proves effective, this could have a significant impact on price level in the medium term with as the demand would pick up again, particularly in the field of transport and energy. Furthermore, we believe that the current price does not reflect the potential for recovery in the transport sector otherwise the price would have been higher.

Abbas Al-Azawi

Alexis Baeriswyl

Valery Sikorskiy

References

BOURSE, Zone, [no date]. PÉTROLE BRENT (LONDON BRENT OIL) : Graphique de Cours Comparatif | XBNT | XX00000BRENT | Zone bourse. [online]. [Viewed 28 October 2020]. Available from: https://www.zonebourse.com/cours/matiere-premiere/LONDON-BRENT-OIL-4948/graphiques-comparatif/

Dubai Crude Oil (Platts) Financial Futures Quotes – CME Group, [no date]. [online]. [Viewed 27 October 2020]. Available from: https://www.cmegroup.com/content/cmegroup/en/trading/energy/crude-oil/dubai-crude-oil-calendar-swap-futures.html

Le pétrole récupère au lendemain d’une forte chute, 2020. Allnews [online]. [Viewed 27 October 2020]. Available from: https://www.allnews.ch/content/march%C3%A9s/le-p%C3%A9trole-r%C3%A9cup%C3%A8re-au-lendemain-d%E2%80%99une-forte-chute

London open: Hopes for oil reprieve on reports of China SPR buy-up, [no date]. FXStreet [online]. [Viewed 27 October 2020]. Available from: https://www.fxstreet.com/analysis/london-open-hopes-for-oil-reprieve-on-reports-of-china-spr-buy-up-202004020828

SHEPPARD, David, 2020. Oil traders braced for balancing act in wake of US election. [online]. 27 October 2020. [Viewed 28 October 2020]. Available from: https://www.ft.com/content/00f63355-c1fa-4cf8-ad18-450c12440106

This Week in Petroleum, [no date]. [online]. [Viewed 29 October 2020]. Available from: https://www.eia.gov/petroleum/weekly/

Westbeck Capital Management LPP, 2020. Monthly Newsletter [medium]. London: Westbeck Capital, september 2020.

Organization of the Petroleum Exporting Countries, 2020. OPEC Monthly Oil Market Report [online]. Vienna: OPEC, 11 november 2020. Available from: https://www.opec.org/opec_web/en/publications/338.htm

ASHRAF, Muqsit, 2020. Big Oil must make seismic changes to survive. [online]. 9 November 2020. [Viewed 17 November 2020]. Available from: https://www.ft.com/content/2596d26c-76a6-46e6-9493-b2490b28fb24

ASHWORTH, Louis, 2020. Oil hits $45 and markets climb on vaccine hopes. The Telegraph [online]. 11 November 2020. [Viewed 17 November 2020]. Available from: https://www.telegraph.co.uk/business/2020/11/11/markets-live-latest-coronavirus-news-pound-euro-ftse-100/

Covid vaccine breakthrough fuels broad global equity rally, 2020. [online]. [Viewed 15 November 2020]. Available from: https://www.ft.com/content/48400214-6caf-4d88-b145-75a3cead2b23

L’Opep risque de regretter son “ami” Trump, craint l’ère Biden, [no date]. Investing.com France [online]. [Viewed 13 November 2020]. Available from: https://fr.investing.com/news/commodities-news/lopep-risque-de-regretter-son-ami-trump-craint-lere-biden-1986755

MEREDITH, Sam, 2020. OPEC cuts 2020 oil demand forecast again on rising Covid cases — sees slower recovery next year. CNBC [online]. 11 November 2020. [Viewed 14 November 2020]. Available from: https://www.cnbc.com/2020/11/11/oil-opec-cuts-2020-demand-forecast-again-on-rising-covid-cases.html

MILLER, Joe, MANCINI, Donato Paolo and KUCHLER, Hannah, 2020. BioNTech and Pfizer raise hopes with breakthrough Covid-19 vaccine. [online]. 9 November 2020. [Viewed 15 November 2020]. Available from: https://www.ft.com/content/497594f4-7771-4af5-98dc-8c98487ea212

Moderna: Covid vaccine shows nearly 95% protection, 2020. BBC News [online]. [Viewed 16 November 2020]. Available from: https://www.bbc.com/news/health-54902908

Oil market has not priced in prospect of a Biden victory | Financial Times, [no date]. [online]. [Viewed 17 November 2020]. Available from: https://www.ft.com/content/0d6d0fbf-93b5-4f01-a6c8-f2d8ca95dc4a

RAVAL, Anjli, 2020a. IEA says coronavirus vaccine unlikely to boost oil market until late 2021. [online]. 12 November 2020. [Viewed 17 November 2020]. Available from: https://www.ft.com/content/eedf958c-c425-4a1b-bc90-6e213f7b8ba4

RAVAL, Anjli, 2020b. Opec slashes oil demand outlook on Covid restrictions. [online]. 11 November 2020. [Viewed 17 November 2020]. Available from: https://www.ft.com/content/ff79bf26-bc3f-4a83-be74-638b3123fc74

SHEPPARD, David, 2020a. Oil producers have more than a pandemic to worry about. [online]. 11 November 2020. [Viewed 17 November 2020]. Available from: https://www.ft.com/content/e1b7bab4-b962-4fab-ae7f-10da597b1cf6

SHEPPARD, David, 2020b. Oil sinks to lowest since May on fears new Covid rules will hit demand. [online]. 29 October 2020. [Viewed 17 November 2020]. Available from: https://www.ft.com/content/1b5f207b-d849-47ee-94be-3f8153c67719

SHEPPARD, David, 2020c. Oil traders tear up demand forecasts as Covid lockdowns return. [online]. 31 October 2020. [Viewed 17 November 2020]. Available from: https://www.ft.com/content/75ff69c2-e83f-4c18-9451-598b6f17edd8

WTI USD | Cours du pétrole brut WTI Dollar américain | Cours Cours du pétrole brut WTI Dollar américain, [no date]. Investing.com France [online]. [Viewed 17 November 2020]. Available from: https://fr.investing.com/currencies/wti-usd

Organization of the Petroleum Exporting Countries, 2020. OPEC Monthly Oil Market Report [online]. Vienna: OPEC, 11 november 2020. Available from: https://www.opec.org/opec_web/en/publications/338.htm