RBOB futures :

https://www.cmegroup.com/trading/energy/refined-products/rbob-gasoline.html

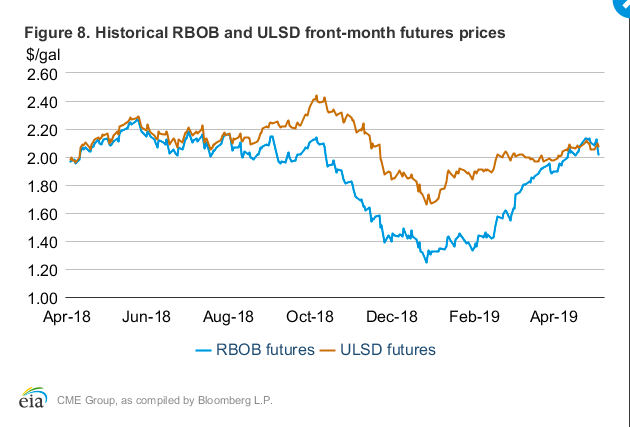

The RBOB futures market is actually in backwardation due to the seasonal pattern of gasoline. The price of gasoline and the demand for gasoline tend to rise during April / May resulting from a different kind of gasoline produced, so the fact that the market is in backwardation makes total sense.

FUTURES DIESEL (ULSD) ultra low sulfur diesel

https://www.cmegroup.com/trading/energy/refined-products/heating-oil_quotes_globex.html

Regarding ULSD futures market, the market is in contengo, the market is well supplied and it is less impacted by the seasonal pattern.

The shutdown of Russia’s Druzhba pipeline

Due to the discovery of the contamination of Russian crude on April 2019, the Russian government has been forced to shut the Druzhba pipeline which pumps 1 million barrels per day of crude, which represents 1% of global supply going to Germany, Poland, the Czech Republic, Slovakia, Hungary, Ukraine and Belarus. Oil from Ust- Luga (a Russian port), has also been contaminated with organic chloride which is a chemical compound used for oil extraction that can damage refining equipment. The Russian supply problems will lead to an increase on oil price and decrease production from the world’s second largest exporter of crude.

Approximately 10 crude tanker with 1 million tonnes of oil, worth more than $500 million still looking for buyers as the oil is contaminated. Vitol, Glencore and Trafigura bought the biggest number of cargoes loaded from the Russian Baltic port of Ust-Luga in late April. According to Reuters, two or three cargoes were also taken by Total and BP trading units. The sellers involved are Rosneft, Russneft, Surgut and Kazakh firms, according to the loading schedules from Ust-Luga port. Buyer such as Eni, Exxon Mobil, Royal Dutch, Shell, PKN and Repsol have refused to take the oil into their refining infrastructure.

The Russian oil supply issue and the unsold cargoes from Ust-Luga could create a supply shortage in Europe and probably increase gasoline and diesel price in the future . The Russian government has promised to fix the quality issue faced by its oil production but nothing has been done since this declaration. The biggest European Terminal in Amsterdam told customers they would not accept any crude coming from russia with organic chloride above 50 ppm.

The acquisition of Anadarko by Chevron or Occidental

On 12th of April 2019, one of the biggest and most productive oil field in the United States called Anadarko has received a merger offer from Chevron. A few weeks later, Occidental, a petroleum company, four times smaller than Chevron has offered a takeover bid superior to Chevron’s offer. Occidental offered to pay $76 per share in cash and stock which represent about 17 percent more than what Chevron agreed to pay to Anadarko ($65 per shares). Occidental’s superior offer has been seen from many wall street analysts as not realistic as Chevon had better revenues. This new offer has raised the stakes in what would be the biggest takeover in the global oil industry in three years.

However, this bidding war has taken another turn when Warren Buffett, an American business magnate considered as one of the most successful investor in the world has announced that he will invest $10 billion to Occidental acquisition of Anadarko. In the deal, Buffet would receive 100’000 shares and 8% annual dividend. On Monday 6 of May 2019, Anadarko Petroleum board said that it intended to reject its first takeover bid, Chevron, as Occidental Petroleum came with a better offer. The combination of Occidental and Anadarko would generate more than 1.4 million barrels of oil per day

U.S. to Clamp Down on Iranian Oil Sales, Risking Rise in Gasoline Prices

Over the last few months, the Trump administration has an aggressive plan to ultimately end the exportation of Iranian oil from other nations, especially China and India. This move is entirely driven by politics since the aim of the Trump administration is to starve the country in order to drastically alter the government and its position in the Middle-East. The core tactics and the american nations was to implement economic sanctions.

While other countries have completely stop their purchases from Iran such Taiwan, Italy and Greece, other countries have long continued their businesses with the country just as usual, such as the aforementioned China and India.

One of the byproduct of this course of action has been the increase in the price of gasoline specifically. When referring to the price of gasoline in America, global head of energy analysis at the Oil Price Information Service, Tom Kloza has stated that “Last summer didn’t go above $3 a gallon as a national average, but this summer, if we don’t have Iranian oil we probably do go over $3”. This clearly displays the high dependance the US has with Iran. The country has planned some sort of counter solution with their own blend of gasoline which is expensive in response to the already expensive regular gasoline already in the market.

https://www.eia.gov/outlooks/steo/marketreview/petproducts.php

https://economictimes.indiatimes.com/topic/petroleum-products