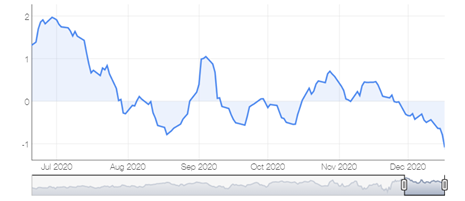

Price mouvement

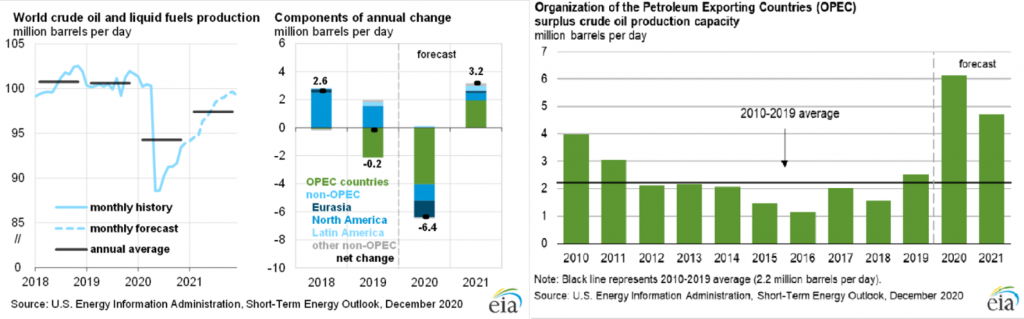

At the OPEC+ meeting on 30 November, it was decided to increase production by 500,000bp each month from January if the situation allows it at their next meeting in early January. The hope of a positive vaccine has a beneficial effect on the continuing rise in the benchmark prices.

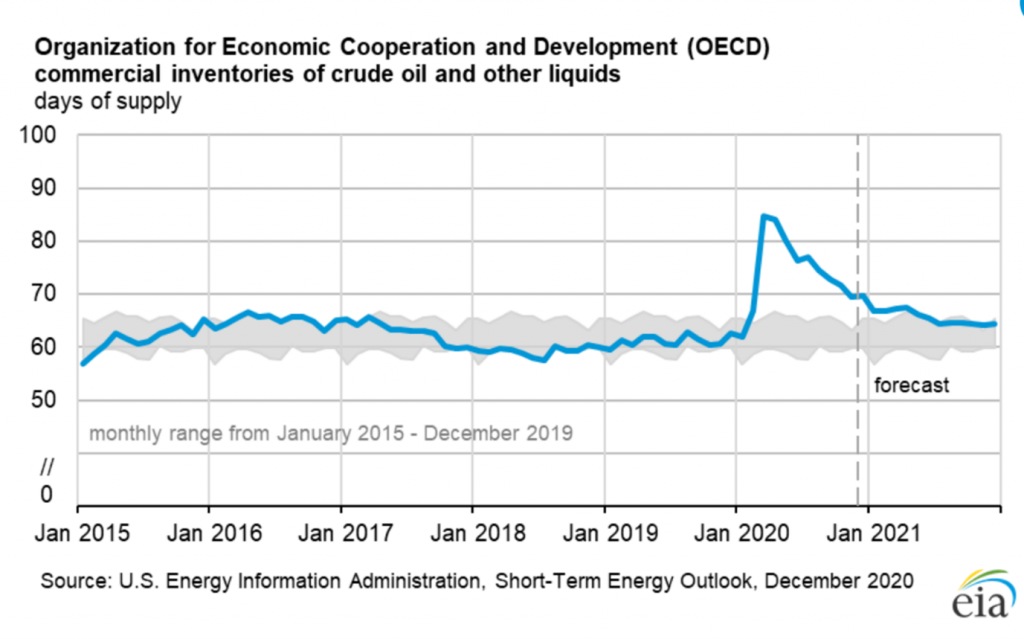

On the oil market, the demand from Asia remains strong but prices are constrained by low refinery margins, increased production and still high stocks. Uncertainties regarding oil demand remain high. Forecasts expecting a decrease by the end of the year followed by an increase in the course of 2021.

Source: https://oilprice.com/oil-price-charts/block/1

Differentials

Since the end of November, the differential in price between Brent (light sweet) and Urals (medium sour) has returned to a discount because supply is stronger than demand.

Source: https://www.neste.com/investors/market-data/urals-brent-price-difference

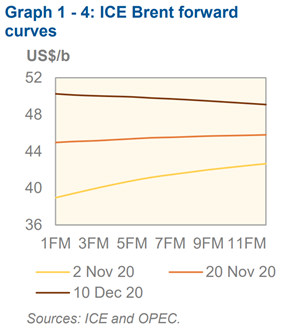

Forward curves

The sustained recovery of the Libyan supply, the weak demand from European refiners and the context of mobility restrictions maintained the contango of November. Then the strong demand from Asia, which reduced unsold volumes and the optimism of a vaccine enabled the contango to be flattened, ending up on backwardation for the December forecasts.

Source:https://www.opec.org/opec_web/en/publications/338.htm

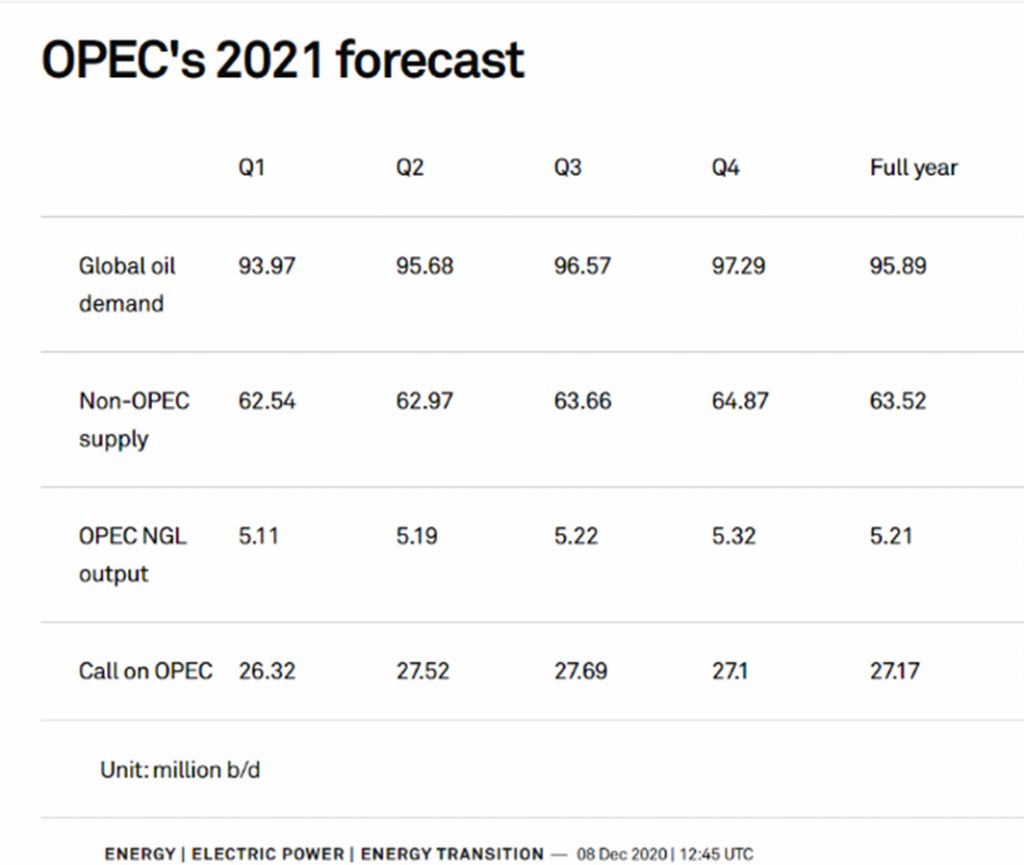

Demand and supply key drivers

What will be driving the market for the next weeks is the evolution of the new OPEC+ agreements, that were established the 3rd of December, they decided to gradually increase production from January, and meet monthly afterward. Russian production was around 10 million barrels per day in November, which was at a low compared to the previous year, mostly due to the cuts. Production will still be reduced to 8.99 million B/D in December, followed by a gradual increase of 500,000 B/D starting January. Demand is indeed expected to rise, but that remains to be seen, as it heavily relies on the pandemic evolution, and the vaccine efficiency, whose fast approval and testing created a price rally. Nevertheless, analyst have lowered their forecast for 2021.

Russia has recently signalled it is bracing for a drastic decline in oil demand, as they think consumption peaked already and that the long term is subject to high risk. This situation might well totally change how Russia will operate, as they intend to switch to greener energy, such as hydrogen. As a matter of fact, companies, such as Gazprom, intend to be producing the clean energy in four years. Russia has already made a roadmap of how they intend to swap from oil to hydrogen, and this will surely change the soviet’s economy drastically.

However, there are some good news, as 50% of the easing in the OPEC+ cuts will benefit Russia and Saudi Arabia, meaning they will be able to produce more, though this also means demand will be affected, and recover more slowly in Q1 of 2021.

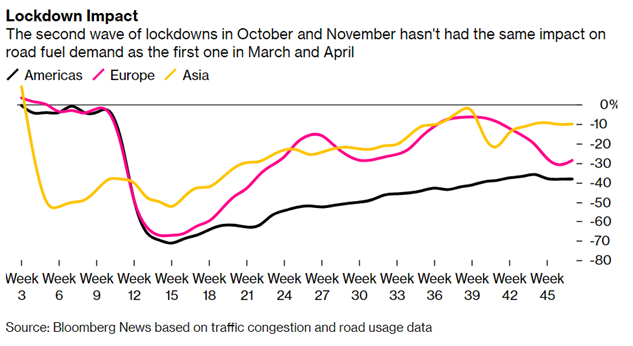

Finally, the second lockdown keeps on influencing demand, and this will continue as the World is going through societal shifts concerning travels. Gasoline and diesel demand being at 90% of their usual levels and jet fuel only at 50% are indicators of this situation. This being said, Asia, who favours Russian crude such as ESPO, has been less affected by the second lockdown and is a key player regarding the demand, with countries like China still importing big quantities of crude oil.

As for stock levels, they are as planned difficult to come by for Russia. However, a global overview show how they rose during those last months in the world.

Source: https://www.eia.gov/outlooks/steo/report/global_oil.php

Recommandations:

On the short term, we recommend to have a long postition as the current measures taken by the OPEC+ organisation are working. However, on the medium to long run, we advise to remain cautious and see how the easing in the production cuts will affect the market, as well as the pandemic evolution with the new vaccines. It is also important to verify if the backwardation will remain before taking any decisions.

Sources:

Oil price charts. Consulté le 14 décembre

https://oilprice.com/oil-price-charts/block/1

Brent crude oil review. Consulté le 15 décembre

https://www.cmegroup.com/trading/energy/crude-oil/brent-crude-oil.html

Urals Brent price differences. Consulté le 16 décembre.

https://www.neste.com/investors/market-data/urals-brent-price-difference

Monthly oil market review. Consulté le 16 décembre

https://www.opec.org/opec_web/en/publications/338.htm

“OPEC – Monthly Oil Market Report” Consulté le 16 Décembre

https://www.opec.org/opec_web/en/publications/338.htm

“Russian Energy Minister Sees 2 Million Bpd OPEC+ Output Increase In April” Consulté le 16 Décembre

https://oilprice.com/Energy/Energy-General/Russian-Energy-Minister-Sees-2-Million-Bpd-OPEC-Output-Increase-In-April.html

“Oil prices rise on vaccine hopes, ship explosion at Saudi Arabia” Consulté le 16 Dévembre

https://energy.economictimes.indiatimes.com/news/oil-and-gas/oil-prices-rise-on-vaccine-hopes-ship-explosion-at-saudi-arabia/79717728

“Russia’s Nov oil output steady on month at 10 mil b/d”. Consulté le 13 Décembre

https://www.spglobal.com/platts/en/market-insights/latest-news/oil/120220-russias-nov-oil-output-steady-on-month-at-10-mil-bd

“Russia braces for permanent decline in oil demand”. Consulté le 13 Décembre

https://oilprice.com/Energy/Crude-Oil/Russia-Braces-For-Permanent-Decline-In-Oil-Demand.html

“The OPEC Mission to balance oil markets is just getting started”. Consulté le 14 Décembre

https://oilprice.com/Energy/Energy-General/The-OPEC-Mission-To-Balance-Oil-Markets-Is-Just-Getting-Started.html