Two weeks ago, we have seen the composition of the gasoline price in the US, now as requested, here is a video which explains the composition of the price of gasoline in Switzerland

In order to illustrate the seasonal pattern of the gasoline that we explained last week we can see the price in Switzerland per months.

Unleaded 95 :

https://www.erdoel.ch/fr/chiffres-faits/prix-de-l-essence/sans-plomb-95-moyenne-mensuelle

Unleaded 98 :

https://www.erdoel.ch/fr/chiffres-faits/prix-de-l-essence/sans-plomb-98-moyenne-mensuelle

Diesel fuel :

https://www.erdoel.ch/fr/chiffres-faits/prix-du-diesel/diesel-moyenne-mensuelle

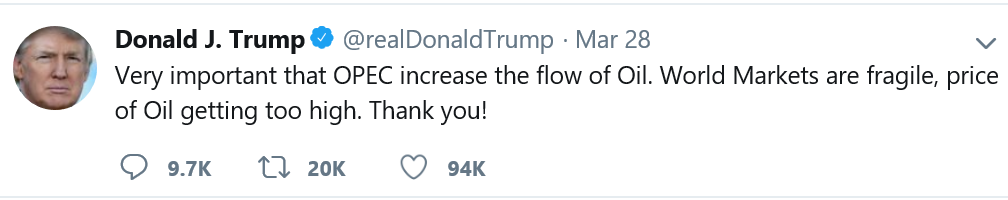

The past few weeks have been very interesting in the oil market. Oil prices took a bit of a hit and President Donald J. Trump has Tweeted on the 28 of March 2019 that OPEC should increase the flow of Oil in order to decrease Oil price. OPEC did not react to Trump’s Twitt. Experts in the oil market have showed that Trump’s Twitt war with OPEC and Russia is waning. Indeed, even if the market react violently to Trump tweet on OPEC, it very quickly recover to its old price levels. Trump’s anti-OPEC rhetoric is clearly losing importance and impact.

Another important new in the Oil market is the Venezuelan crisis. Venezuela, which is a key Oil producer have shut down all operation due to issues the country is facing. During the past few weeks, China has sent humanitarian help to Venezuela when humanitarian aid from the US has been blocked along the Venezuela-Colombia border. Many people in the Oil industry believe that a trade war is taking place there. When the US and other western countries are struggling with high Oil price, in China the situation is totally different. All trading houses in China are state-run companies. During the past week, Chinese companies have received orders from the Chinese government to produce more Oil even if the cost of production and storage is relatively high. For instance, Sinopec, one of the largest refiner and one of the two largest oil and gas producers in China has announced a fourfold increase in capital spending. This is a direct response to Beijing’s call for oil and gas companies to boost domestic production.

With thin profit margins in the oil sector, commodity trading houses have been looking for the next big movement in the energy industry. Trading giants such as Gunvor Group LTD, Trafigura Group Pte. Ltd and Vitol SA are all investing into the liquefied natural gas sector. They are all looking to buy more natural gas and therefore move away from dirtier and high pollution commodity such as crude oil. The world’s biggest commodity trading houses are looking to reshape the energy industry but they are also looking a new way to increase margin. The 27 March an article from Bloomberg has quoted Mr. Russel Hardy, the Chief Executive Office of Vitol who said that “ The liquified natural gas sector looks like a much younger crude market,it is an area that can grow and that is positive for trading houses”

To conclude, there were many important news related to Oil market, but what we can retain is that many important trading houses such as the Chinese Sinopec, have reported a huge drop in profit. For instance, Sinopec has reported a 76% drop in its latest quarterly profit for October- December 2018. The OPEC supply cut, the Venezuelan production shut down and the Iranian sanctions have lead to the biggest inventory reduction when stocks normally increase at this time of the year.

When looking into the diesel situation specifically, there is a growing problem which is dubbed the illegal diesel trade. It is mainly present in the city of Dubai and the official has organised a dedicated task force in order to the tackle this growing problem. And that problem is that 62% of the companies inspected by that task force regularly trade illegal diesel. That illegality comes from the sulphur content in the diesel, which based on the Federal Cabinet Decision No. 37 of 2013 the sulphur content must be extremely low. Specifically, the content must not be over 10 parts per million (ppm) of sulphur. That 62% of companies were trading diesel barrels with sulphur content that far exceeded that limit. Not only is it a violation of the UAE, but also results in extremely harmful gas emissions.

https://oilprice.com/Energy/Oil-Prices/Expect-Higher-Oil-Prices-As-OPEC-Clashes-With-Trump.html

https://oilprice.com/Energy/Energy-General/Whats-Keeping-Oil-From-Rallying-To-75.html