Price movement recap

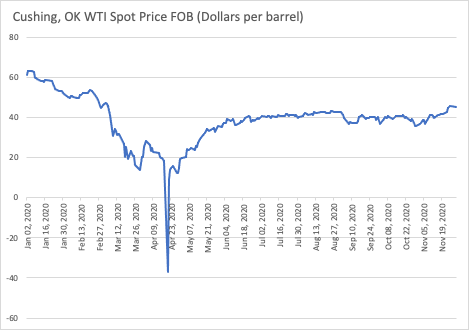

WTI Spot price has remained more or less around USD40/barrel from September to November and now since November 19th we can see an increase in price that reached 45.2 on the 30th of November. This increase in price might be explained by the fact that the economy is slowly recovering and also because of many announcements of potential prospects for vaccines against covid-19 from 2021.

Forward curve 2.12.20

CME GROUP., [09.11.20]. NYMEX WTI Crude Oil Futures & Options. In : [online].

Available at : http://www.cmegroup.com/trading/energy/crude-oil/light-sweet-crude.html.

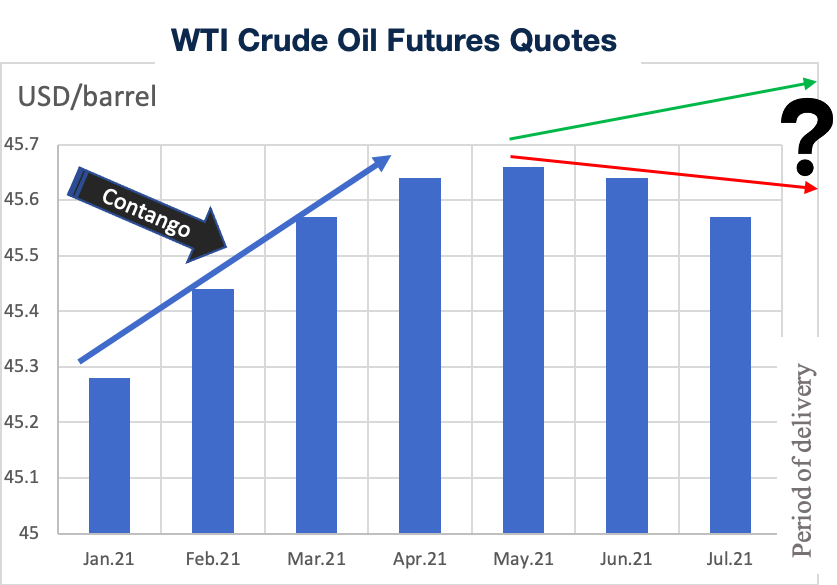

The forward curve shows that the market is in contango for the moment which means the spot price for delivery now is lower than today’s price for delivery in future. This means our market is relatively well supplied. Supply is greater than demand now,

However, as we can see from May 2021, we cannot be sure that the market will remain in a contango situation or will go to backwardation. Indeed, OPEC recently met and agreed to delay their planned increase in production, so there are uncertainties about whether the market will be well supplied or in shortage. If the market underestimates the economic recovery and consequently is faced with a shortage, it would mean that demand is greater than supply. Hence the spot price for delivery now might be higher than the price for delivery in a future period. The demand would send a message to the market: Don’t store! Deliver now!

ANN KOH AND ALEX LONGLEY., [02.12.20]. Oil prices stabilize as OPEC focuses on diplomacy. In : [Online]. [Consulté le 3 décembre 2020]. Available at : https://www.worldoil.com/news/2020/12/2/oil-prices-stabilize-as-opec-focuses-on-diplomacy.

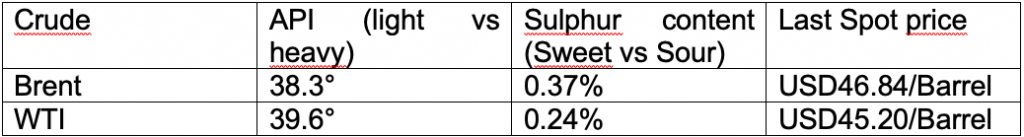

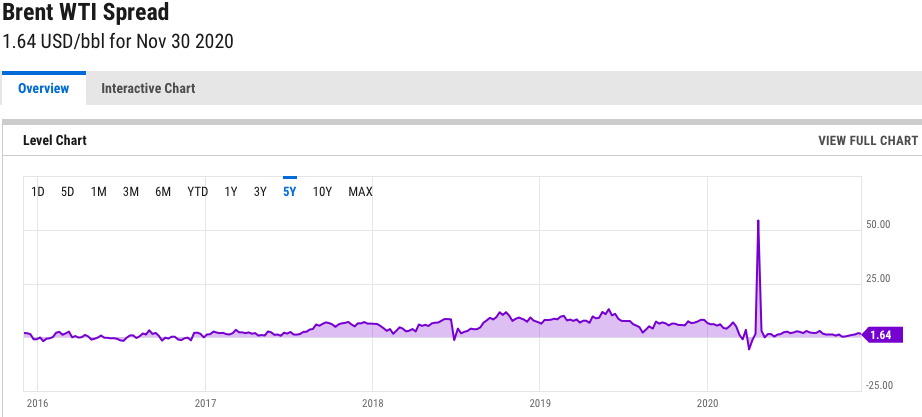

Differential WTI vs Brent: SHALE OIL !

WTI crude oil is shipped by pipeline to Cushing. Its storage site, situated at the far end of Oklahoma, makes it expensive to ship and export in terms of transportation, rendering it primarily processed in the national territory and intended for United states consumption. Pipeline market

Brent crude oil, due to the geographical position of its storage location, which has a deepwater port, large volumes are moved by tankers around the world, reinforcing its relevance as a global reference.Off-shore market.

The main cause of the differential in WTI relative to Brent are due to an excess of light crude oil (SHALE) on the US market and the inability of US refineries to refine it. Since 2015, Ban on exporting US crude is lifted, narrowing the differential. But still, US crude exports are challenging and expensive.

ANON., [10.10.18]. Oil: Why is Brent more expensive than WTI? | Hellenic Shipping News Worldwide. In : [Online]. [Consulté le 3 décembre 2020]. Available at : https://www.hellenicshippingnews.com/oil-why-is-brent-more-expensive-than-wti/.

ANON., [03.12.20]. Brent WTI Spread. In : [Online]. [Consulté le 3 décembre 2020]. Available at : https://ycharts.com/indicators/brent_wti_spread.

Supply and demand dynamic – Inventory levels

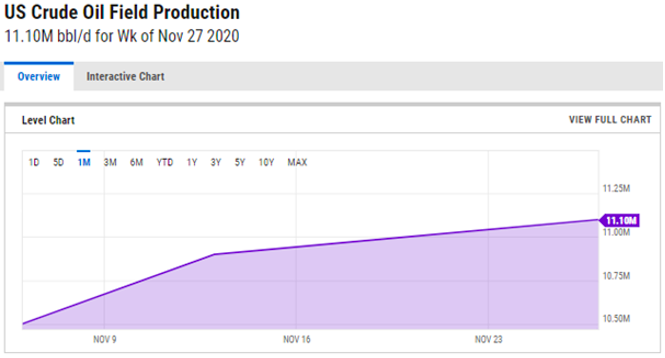

During the week that ended the 20 of November, the American Petroleum Institute (API) has reported the oil production at 11 million barrels per day, it represents a build of 3.8 million barrels in oil inventories.

The following week, an increase in inventories of crude oil of 4.146 million barrels has been reported by the API. Both weeks are above what analysts expected.

According to analysts, OPEC+ is likely to extend its current production cuts until January, rather than easing them.

An acceleration in shale drilling would complicate OPEC+’s calculations, but the recovery in U.S. shale drilling “remains modest and aimed at stabilizing production instead, as confirmed by recent earnings comments and a commitment to return cash to shareholders,” Goldman analysts wrote in a note.U.S shale production is expected to decline by 140,000 bpd in December, month-on-month, according to the Energy Information Administration (EIA). The decline is spread between all major shale basins (Permian, Bakken, Eagle Ford, Niobrara, Anadarko)

ANON., [27.11.20]. U.S. Shale Production Continues Its Decline. In : OilPrice.com [online]. [Consulté le 3 décembre 2020]. Available at : https://oilprice.com/Energy/Energy-General/US-Shale-Production-Continues-Its-Decline.html.

Recommendations:

December 1st, 2020.

General oil prices were trading down, while the WTI Crude stayed stuck around $40s dollars per barrel. Despite the Covid-19 situation optimism, OPEC ended its 30th November meeting without production plans for 2021. US shale oil output is expected to have a big drop in supply according to the US Energy Information Administration (EIA). Due to the reduction of spending in this production.

Josh Owens., [10.11.20]. Oil Optimism Returns On Fresh Vaccine News | OilPrice.com. In : [Online]. [Consulté le 3 décembre 2020]. Available at : https://oilprice.com/Energy/Energy-General/Oil-Optimism-Returns-On-Fresh-Vaccine-News.html.

With the crash in prices due to the demand collapse in early March, the U.S. drillers reduced their spending/production in response to it. Which led to thousands of lost jobs in the sector. The U.S. shale has suffered from the pandemic this year, moreover with the incoming Administration of Joe Biden the shale will again be targeted. As Joe Biden’s promise to ban new oil and gas drilling on federal lands and waters.

Tsvetana Paraskova., [25.11.20]. U.S. Shale Bankruptcies Accelerate Despite Pandemic Protection. In : OilPrice.com [online]. [Consulté le 3 décembre 2020]. Available at : https://oilprice.com/Energy/Energy-General/US-Shale-Bankruptcies-Accelerate-Despite-Pandemic-Protection.html.

Compared to our last bulletin where the price was at $42.59 and now raising to $44.70 per barrel (price today for delivery in december) the recommendation was to be long (buy) for the next 3-6 months and still the same as of today. The future consumption of oil is expected to rise continuously throughout the year, since the arrival of the pandemic’s protection. The market being well supplied will be contango. Therefore it will be better to be short (sell) in a future period sometimes next year.

ANON., [2.12.20]. WTI Crude Oil Price Charts. In : OilPrice.com [online]. [Consulté le 3 décembre 2020]. Available at : https://oilprice.com/oil-price-charts.